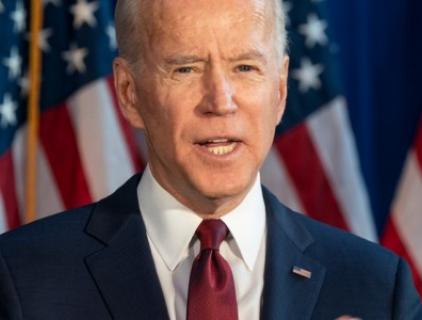

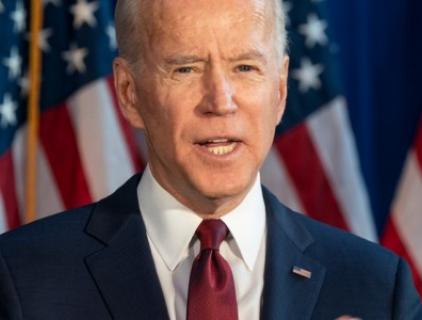

President Joe Biden has been scrambling to put a lid on runaway oil prices over the past month.

Biden’s latest plan is a joint strategic oil reserve release, cooperating with the likes of China, India, and Japan.

Biden’s latest plan is a joint strategic oil reserve release, cooperating with the likes of China, India, and Japan.

2021/11/24 21:01

The march towards energy independence began 10 years ago, and oil and gas imports have been shrinking ever since. The energy independence's trajectory is clear, and the impact of the COVID-19 demand destruction will likely be temporary in the long run.

2021/11/23 19:08

OPEC delegates: releasing millions of barrels from major oil consumers’ SPRs is not supported by market conditions

2021/11/23 19:03

The COVID-19 pandemic has taken a particularly harsh toll on Colombia’s economically-dependent oil and gas industry.Colombia desperately needs to ramp up oil and gas production.

2021/11/23 18:59

Reuters: China is preparing to release crude oil from its strategic reserve

2021/11/19 18:19

Crude oil prices gained today after the Energy Information Administration reported a crude oil inventory draw of 2.1 million barrels for the week to November 12.

2021/11/18 19:45

Rystad Energy’s annual cost of supply analysis has revealed that costs within the upstream sector have come down considerably in 2021, making new oil more competitive and significantly cheaper to produce. The average breakeven price for new oil projects has dropped to around $47 per barrel – down around 8% over the past year and 40% since 2014, with offshore deepwater remaining one of the least expensive sources of new supply.

2021/11/18 19:41

The newly resuscitated Iraq National Oil Company (INOC) has been authorised by the government in Baghdad to directly negotiate with U.S. oil giant, Chevron, for it to develop the long-delayed Nasiriyah oil field in the southern DhiQar province, according to several domestic news sources.

2021/11/18 19:39

Having just hosted COP26 in Glasgow, Boris Johnson is now coming under pressure to cancel plans to explore the Cambo oilfield - a project that is thought to hold 800 million barrels of oil

2021/11/15 16:46

Crude oil demand is rebounding faster than supply, pushing prices higher

EIA: This year, demand for petroleum, both in the United States and globally, has largely returned to the pre-pandemic levels in 2019

EIA: This year, demand for petroleum, both in the United States and globally, has largely returned to the pre-pandemic levels in 2019

2021/11/12 09:14

The Democratic-sponsored $1-trillion infrastructure bill last weekend became the latest bullish driver of oil prices

More consumption growth lies in wait once travel begins in earnest and jet fuel demand picks up

The Biden Administration has limited options to keep oil prices in check this winter

More consumption growth lies in wait once travel begins in earnest and jet fuel demand picks up

The Biden Administration has limited options to keep oil prices in check this winter

2021/11/12 09:07

Independent refiners in China boosted imports of oil from Iran between August and October

Between August and October 2021, China imported on average 560,000 barrels per day (bpd) of Iranian oil

Between August and October 2021, China imported on average 560,000 barrels per day (bpd) of Iranian oil

2021/11/12 09:02

President Joe Biden has been scrambling to put a lid on runaway oil prices over the past month.

Biden’s latest plan is a joint strategic oil reserve release, cooperating with the likes of China, India, and Japan.

Biden’s latest plan is a joint strategic oil reserve release, cooperating with the likes of China, India, and Japan.

The march towards energy independence began 10 years ago, and oil and gas imports have been shrinking ever since. The energy independence's trajectory is clear, and the impact of the COVID-19 demand destruction will likely be temporary in the long run.

OPEC delegates: releasing millions of barrels from major oil consumers’ SPRs is not supported by market conditions

The COVID-19 pandemic has taken a particularly harsh toll on Colombia’s economically-dependent oil and gas industry.Colombia desperately needs to ramp up oil and gas production.

Reuters: China is preparing to release crude oil from its strategic reserve

Crude oil prices gained today after the Energy Information Administration reported a crude oil inventory draw of 2.1 million barrels for the week to November 12.

Rystad Energy’s annual cost of supply analysis has revealed that costs within the upstream sector have come down considerably in 2021, making new oil more competitive and significantly cheaper to produce. The average breakeven price for new oil projects has dropped to around $47 per barrel – down around 8% over the past year and 40% since 2014, with offshore deepwater remaining one of the least expensive sources of new supply.

The newly resuscitated Iraq National Oil Company (INOC) has been authorised by the government in Baghdad to directly negotiate with U.S. oil giant, Chevron, for it to develop the long-delayed Nasiriyah oil field in the southern DhiQar province, according to several domestic news sources.

Having just hosted COP26 in Glasgow, Boris Johnson is now coming under pressure to cancel plans to explore the Cambo oilfield - a project that is thought to hold 800 million barrels of oil

Crude oil demand is rebounding faster than supply, pushing prices higher

EIA: This year, demand for petroleum, both in the United States and globally, has largely returned to the pre-pandemic levels in 2019

EIA: This year, demand for petroleum, both in the United States and globally, has largely returned to the pre-pandemic levels in 2019

The Democratic-sponsored $1-trillion infrastructure bill last weekend became the latest bullish driver of oil prices

More consumption growth lies in wait once travel begins in earnest and jet fuel demand picks up

The Biden Administration has limited options to keep oil prices in check this winter

More consumption growth lies in wait once travel begins in earnest and jet fuel demand picks up

The Biden Administration has limited options to keep oil prices in check this winter

Independent refiners in China boosted imports of oil from Iran between August and October

Between August and October 2021, China imported on average 560,000 barrels per day (bpd) of Iranian oil

Between August and October 2021, China imported on average 560,000 barrels per day (bpd) of Iranian oil