China's oil sector sets low expectations for ice-breaking trade talks with US

Chinese oil and chemical players and analysts remain cautious amid uncertainties over US-China trade relations, even though leaders from both countries are scheduled to meet this weekend in ice-breaking trade talks. This move is widely regarded as an optimistic first step in mending ties, they told Platts, part of S&P Global Commodity Insights, on May 7.

China's Ministry of Foreign Affairs said May 7 that Vice Premier He Lifeng will visit Switzerland over May 9-12, and the US said Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer will attend the talks.

"It is good to start to talk, but the outcome is uncertain," said a senior official with a Chinese energy think tank.

These discussions mark the first talks since US President Donald Trump announced tariffs on April 2, coming just ahead of May 13, which is the deadline for the grace period on additional tariffs imposed by Beijing on all imports from the US.

US-China trade and goods shipments have recently plummeted due to the retaliatory tariffs, leading to a downgrade in GDP expansion to 3.7% and downward adjustments in oil demand growth to 78,000 b/d in China, compared to the earlier forecasts of 4.2% and 270,000 b/d made in January, respectively, according to analysts at S&P Global Commodity Insights.

US-China trade and goods shipments have recently plummeted due to retaliatory tariffs, leading to a downgrade in GDP expansion to 3.7% and downward adjustments in oil demand growth to 78,000 b/d in China, according to analysts at S&P Global Commodity Insights. This is down from earlier forecasts of 4.2% and 270,000 b/d made in January.

Meanwhile, China's purchasing managers index flipped to 49 in April after the tit-for-tat tariffs, indicating a contraction.

After news broke that US officials would meet with their Chinese counterparts to discuss a trade deal, the July ICE Brent crude oil futures contract was up 52 cents/b at 1014 GMT from the previous settlement at $62.67/b, while the June WTI Crude Futures contract was up 59 cents/b at $59.68/b.

"However, a more comprehensive trade deal is still far from certain given broader US-China relations, and most policy experts do not expect the global trade order to revert to previous levels," said Eric Yep, Principal Analyst, First Take Gas, at Commodity Insights.

A Beijing-based foreign policy observer said it was difficult to predict the outcome of the talks, "as there are significant differences in interest between China and the US."

China's National Development Reform Commission published a column on its official website May 7 saying that the US "should deeply rethink and make adjustments, accelerating actual actions to correct trade bullying behaviors and return to the right path of properly resolving economic and trade differences through equal negotiations."

A feedstock procurement manager with a state-run oil firm said the US needs to make the first move to de-escalate the tariffs because China "is unlikely to be the one to compromise."

"The government announced a series of stimulus measures, including interest rate cuts and a significant liquidity injection, on the same day," the feedstock procurement manager said. "This can be seen as a preparation to mitigate the economic damage from a potential negative outcome of the trade talks, if that occurs."

Meanwhile, China's State Council Information Office on May 7 rolled out a series of specific measures to support entities significantly affected by tariffs, suggesting the country is preparing for a protracted conflict.

The first US-China trade dispute was initiated by Trump in February 2018. It lasted for two years, with tit-for-tat tariffs and rounds of negotiations, until the phase 1 trade deal was signed in February 2020.

An LPG trader with a Chinese propane dehydration plant said a deal would be made, "sooner or later, as neither China nor the US can bear the damage."

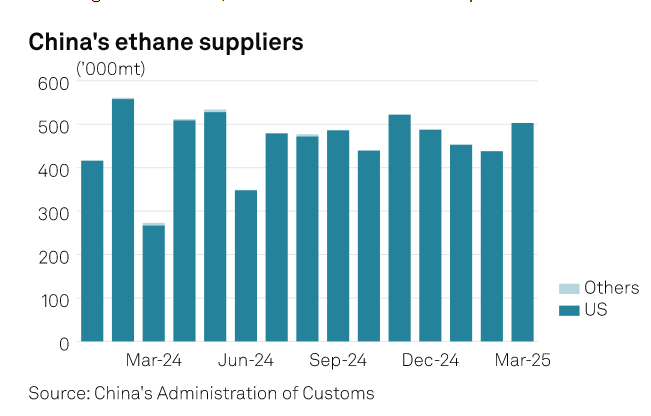

Chinese chemical plants that rely on imported ethane and propane from the US are being hit the hardest, and have asked for tariff exemptions.

"The talks are a crucial watch point for us because there is still no formal confirmation from the government about a tariff exemption on ethane," said an official at a private ethane-to-ethylene plant.

The Chinese government is likely to allow an exemption for around 131 US goods, including ethane, from its 125% retaliatory tariffs, due to significant reliance on the US. Without an exemption, US imports after May 13 will incur the tariffs.

"If there is positive progress, I believe ethane will be exempted from the additional tariff. If not, we may have to go through the declaration process to know whether there is an exemption or not," the official said, adding that the plant is due to receive a shipment of US ethane later this month.

LPG, however, was not on the exemption list even though the US supplies about 40% of China's LPG imports.

To switch to Middle Eastern supplies, Chinese buyers were heard paying a premium of about $70/mt against Saudi Aramco's contract price, reducing process margins.

Data from local information provider JLC showed that Chinese PDH plants had reduced their utilization rates to 60.85% by the end of April, down from an average of 72% in March.