FEATURE: Oil companies race for AI edge in upstream projects

Energy companies are leaning into artificial intelligence to speed up exploration, improve efficiency and streamline maintenance to help trim costs at a time when investment remains a sector-wide challenge.

Speaking at the OPEC International Seminar in Vienna July 9-10, executives from the world's leading oil producers were eager to exhibit great leaps forward in their use of AI, which is already shaving weeks off exploration times and saving billions of dollars in expenditures.

In the oil sector, AI is speeding up procedures at every stage of the production life cycle, from early exploration through to drilling and refinery optimization.

Aramco, the world's largest oil producer, estimated that it saved $4 billion by integrating around 500 AI use cases into its operations in 2024, its CEO, Amin Nasser, told the conference.

"In seismic, it's reduced the requirement from months to weeks to days," Nasser said, adding that the company's new technical capabilities had improved the predictability of failures and reduced downtime.

BP is employing AI to detect kicks on production wells with 98% accuracy and can plant new ones 90% faster in hot spots like Azerbaijan, CEO Murray Auchincloss said.

Helping with offshore push

Also eager to leverage new technical capabilities, Kuwait's state-owned KPC is partnering with Google and Microsoft on AI projects, and said smart drilling had supported its lucrative push into offshore exploration.

"We have drilled three wells with the benefit of analysis using AI technology," CEO Shaikh Nawaf al-Sabah said, noting "major discoveries" supported by better well placement and smart intelligence.

The first well alone, in the Al-Nokhtana field, is expected to unlock oil reserves equivalent to three years of production for the entire state of Kuwait, Sabah said, promising an announcement on the third "very shortly."

Also, AI has supported a drive to slash emissions linked to gas flaring, Sabah said, adding that KPC has cut flaring from roughly 16% to less than 0.5% in the last two decades.

In the OPEC World Oil Outlook published July 10, the oil exporter group's analysts observed that AI has given producers the confidence to venture into increasingly challenging reservoirs.

By combining AI algorithms and real-time data censors, producers can adjust to drilling fluid composition and bit rotation speeds to employ sophisticated optimization strategies, often automatically, the report said.

In renewables, predictive weather forecasting is also improving predictability for generation from offshore wind facilities and informing maintenance decisions, Shell CEO Wael Sawan said.

The energy question

It isn't just AI efficiency gains that has oil companies animated. For many, the huge potential energy demand linked to AI uptake underscores an important, lasting role for oil and gas.

In the opening address to the OPEC Seminar, Saudi Arabia's energy minister, Prince Abdulaziz bin Salman, was quick to identify surging data center demand as a key rationale for the group's view that "peak oil" is nowhere in sight.

"AI is just starting, demand will continue to move forward, and we're going to need multiple forms of energy," the prince said.

Abdulaziz Alobaidli, chief operating officer of Emirati state-owned renewables company Masdar, said AI's "main bottleneck" was the energy it requires, citing an oft-repeated figure that a ChatGPT search guzzles 10 times the electricity of the Google equivalent.

According to Aramco's Nasser, 3% of today's power demand goes to AI, data centers and crypto, with that figure set to reach 4-6% by 2030.

"We see a huge spike in power demand," BP's Auchincloss said, estimating that 70% of energy supply for data centers in the US will come from natural gas.

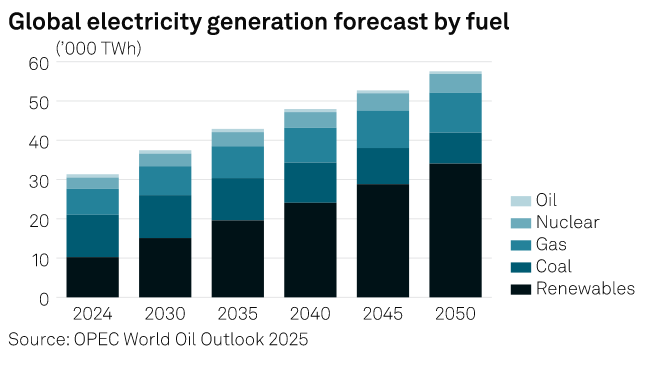

So far, growing global energy demand has continued to be mostly met by oil and gas. As a result, a spurt of AI-linked demand could quickly overwhelm renewables capacity and boost the call on fossil fuels, OPEC has argued.

In its July 10 report, the bloc doubled down on its view world oil demand will continue to grow for decades and hiked its forecast for 2050.

However, that outlook remains in stark contrast to that of the International Energy Agency, which sees peak demand by the end of this decade, and several Western financiers.

As a result, energy companies will likely welcome AI innovations that help them mine oil reserves sooner rather than later. But outside the CEO panels, technical sources say AI innovations can only go so far.

"When you're doing technical work, seismic is probably 5% of the time, [while] 95% of the time is just getting the approvals," one industry source for a European oil producer said, speaking on condition of anonymity.

"I use ChatGPT liberally to do presentations and emails," he said. "But the ability to identify really high crude prospects was already there."