OPEC+ agrees to fully unwind voluntary crude output cuts in Sept

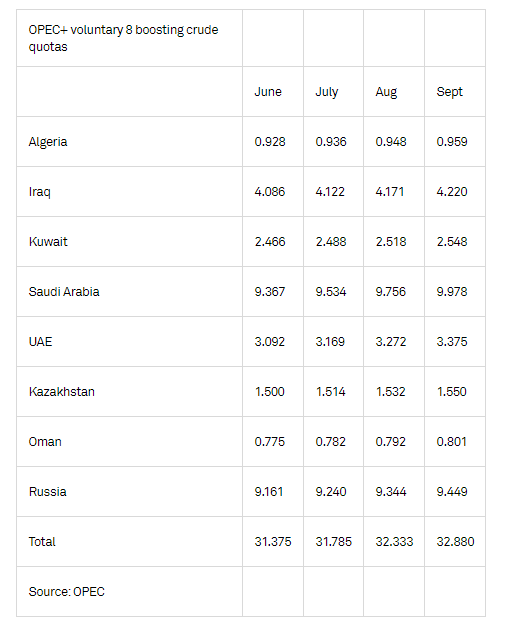

Eight producers implementing voluntary crude production cuts agreed Aug. 3 to increase quotas by 547,000 b/d in September, OPEC said in a statement released after a meeting of the group.

Citing a "steady global economic outlook" and "current healthy market fundamentals", OPEC said that the phase out may be paused or reversed if market conditions require a change in strategy.

"This flexibility will allow the group to continue to support oil market stability," OPEC said.

The move was widely expected, as prices have held up through quota increases in recent months. One delegate said that the group took just 16 minutes to approve the September quota levels.

The current plan fully phases out the 2.2 million b/d voluntary production cuts implemented by the group that comprises Saudi Arabia, Russia, Iraq, the UAE, Kuwait, Kazakhstan, Oman and Algeria.

OPEC said that the group noted that the latest plan provides an opportunity to accelerate compensation cuts that are being implemented for overproduction since the beginning of 2024.

OPEC said previously that the next deadline for submission of revised compensation plans is Aug. 18.

The voluntary cutters will continue to meet monthly to review market conditions, conformity and compensation, with the next meeting scheduled for Sept. 7, OPEC said.

Price pressure

OPEC+ is bringing barrels back to the market with prices mostly stable since the group started to unwind the voluntary cuts.

Seasonal demand, as well as increased supply risks due to the Israel-Iran conflict and some progress in US tariff talks have supported prices in recent months.

Platts assessed Dated Brent at $71.39/b on Aug. 1, slightly below levels in late February, when the group confirmed its plans to start bringing barrels back to market in April.

Some analysts expect OPEC+ to pause quota increases after September. The group is also implementing 3.66 million b/d of groupwide cuts agreed in 2022 and 2023 that are currently in place until the end of 2026. These cuts are next due to be discussed at a full OPEC+ ministerial meeting scheduled for Nov. 30.

"That puts the Northern Hemisphere market past the seasonal peak in demand, so I'll be watching if OPEC+ continues to bring supply to the market or pauses for the winter," said Skip York, nonresident fellow at the Center for Energy Studies at the Baker Institute for Public Policy. "My hypothesis is a seasonal pause because they can always add barrels if the market needs them." He predicted the September increase.

The group may be forced to tackle a difficult price environment up to the end of 2025, however, if analyst forecasts of a significant drop by the end of the year come to pass. S&P Global Commodity Insights forecast a 2 million b/d surplus in supply over demand in the fourth quarter, potentially pushing Dated Brent down to $58/b in December.