China's crude imports set to slow over rest of 2025 absent SPR buying

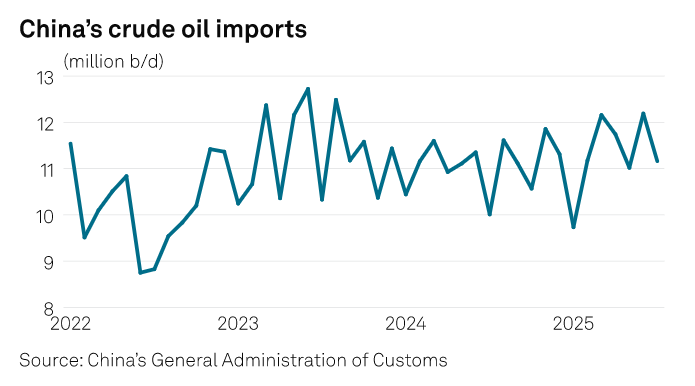

China's crude imports over the rest of 2025 look set to continue retreating from the nearly two-year high reached in June given limited crude import quota availability and lackluster economic growth, although a potential increase in buying for strategic petroleum reserves could keep them at or close to current levels approaching 11.3 million b/d.

Neither the government nor SPR operators have confirmed any plans for increased buying for the SPR but market talk about stock build plans over the rest of the year and into next has been growing lately.

Some estimates are that 100 million barrels will be added to strategic reserves over the second half of 2025 and the first quarter of 2026.

China has stopped providing statistics about the SPR since the latest data showed 276.6 million barrels were held at the end of 2017, but according to data from Ursa Space the SPR was almost unchanged year over year at about 212 million barrels last month.

Meanwhile, commercial stocks hit an all-time high of 997.3 million barrels in July, rising by 95 million barrels from the 902 million barrels in the same month last year, according to Ursa Space data.

Overall stocks stood at 1.21 billion barrels in July, an all-time high, as a greater proportion of China's rising crude imports over January-July went into commercial storage.

Asia's top oil consumer imported 11.29 million b/d of crude oil in January-July, rising by 3.2% or 355,000 b/d from the relatively low base of 10.94 million b/d in the same period of 2024, data released by China's General Administration of Customs showed on Aug. 7.

However, after an 8.4% month-on-month reduction in crude imports to 11.16 million b/d in July from the 22-month high in June, market sources said China's crude inventory is starting to fall back in August.

Kpler data showed that the country's crude inventory has decreased by about 7.83 million barrels in August so far from the record high reached in July.

Limited quotas

Without any SPR stock build, Mengbi Yao, a principal analyst with S&P Global Commodity Insights, projected China's crude imports would slow to about 11.05 million b/d over August-December, falling from 11.23 million b/d in the same period of 2024.

She primarily attributed the reduction to the limited import quota availability in the independent refining sector, while the state-owned refiners maintain low feedstock inventories for operation.

The country's independent refineries imported about 4.03 million b/d of crude in the first seven months, jumping by around 721,000 b/d from the 3.31 million b/d in the same period of 2024, Platts data showed.

Unlike their state-owned peers that are free from crude import controls, the inflows of independent refineries are restricted by quotas.

Their remaining quotas amounted to 173.34 million mt or 3.48 million b/d for 2025 as of Aug. 7, excluding the 17.12 million mt quotas awarded to the bankrupted refineries under ChemChina.

Therefore, the quota availability for August onward stood at 2.72 million b/d, which is 32.7% below their average imports in the first seven months of the year, Platts data showed.

"The independent refineries are more likely to rely on the stocks in this case," a Beijing-based analyst said.

However, if the SPR buying does emerge over the coming quarters it could keep imports at or close to levels seen in the first half of the year.

"Buying for the SPR will still sustain imports at as high as 11.3 million b/d through the rest of 2025, however, even as commercial restocking eases after huge builds in Q2 2025," a London-based analyst said.

China has been growing its total storage capacity. Including commercial and SPR, it had reached 320 million cu m (2.03 billion barrels) by the end of 2024, increasing by 13.03 million cu m year over year, according to market sources.

They estimated that about 160 million cu m would be under construction in 2025-2026, most of it concentrated in the provinces and regions along the coast, led by Shandong, Fujian, Guangdong, Zhejiang and Tianjin.

Economy to dampen oil demand

Meanwhile, challenges remain in China's economic outlook, dampening the country's oil demand, while consumption of transportation fuels continues on a downward trend as the transition to electric vehicles gathers pace.

Commodity Insights analysts expect China's GDP growth to slow in the second half from 5.3% in H1 due to reduced domestic stimulus and the impact of the trade conflict with the US.

Crude oil imports are forecast to increase by 170,000 b/d year over year in 2025, recovering from a decline of 235,000 b/d in 2024, with the primary support coming from the commissioning of new refining capacities.