Chinese refiners embrace Canadian heavy crude via expanded TMX pipeline

Crude exports from Canada's Pacific Coast climbed in August, with increased shipments to both the US and China, keeping Canadian crude price discounts to WTI narrow, S&P Global Commodities at Sea and Platts data showed Sept. 12.

Canada exported 13.7 million barrels of crude from the Pacific Coast in August, up from 13.1 million barrels in July and 12.4 million barrels in June, CAS data showed. Of the August exports, 5.2 million barrels were sent to the US and 6.8 million barrels to China.

While exports have fallen since a recent peak of 16.5 million barrels in March, they are up from just 1.7 million barrels in May 2024, when the Trans Mountain crude pipeline, or TMX, was expanded.

TMX added 590,000 b/d of new capacity to the 300,000 b/d legacy pipeline, shipping both heavy and light barrels from Edmonton, Alberta, to the Westridge Marine terminal in British Columbia.

"China is viewing WCS [Western Canadian Select] barrels as a reliable supply source with a shipping time that is 10 days less compared with the US Gulf Coast," Greg Stringham, a former vice president with the Canadian Association of Petroleum Producers, said.

"There is also a seasonal element to the growing exports. With the summer driving season coming to an end in North America, more barrels are now available for exports on TMX," Stringham said, adding there is a growing relationship between Chinese refiners and Western Canadian heavy oil producers that will result in more barrels moving to the Canadian Pacific Coast rather than USGC.

The increased flows have tightened Canadian crude price discounts. FOB Westridge Cold Lake crude was last assessed by Platts, part of S&P Global Commodity Insights, at a $2.09/b discount to WTI Sept. 11, having steadily trended up from a $9.22/b discount July 31, 2024.

Drop in US heavy exports

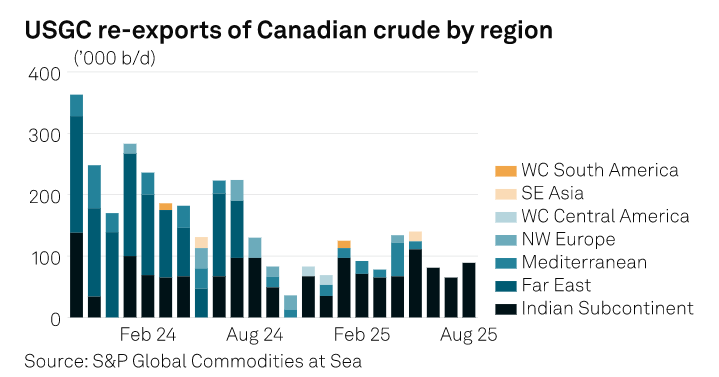

With more Canadian crude being routed to the Pacific terminals, less is being re-exported from the US Gulf Coast. Just 2.8 million barrels of Canadian crude were exported from the USGC in August, with all of that bound for India, down from 6 million barrels in June 2024, CAS data showed.

Fewer Canadian barrels might be available for re-export because of tighter supplies of heavy waterborne crudes available to USGC refiners.

The bulk of Canadian crude imports is delivered via pipeline. Total US imports of Canadian crude were at 3.9 million b/d the week ended Sept. 5 on a four-week moving average, up from 3.4 million b/d the week ended June 20, US Energy Information Administration data shows.

The EIA does not break down imports by state or region on a weekly basis. The EIA's most recent monthly data shows 380,000 b/d of Canadian crude delivered to the USGC, and 2.6 million b/d going to the Midwest.

CAS data showed 28.4 million barrels of waterborne heavy crude were exported to the US in August, up from 26.1 million barrels in July. However, that was down from 40.3 million barrels in April and 33.3 million barrels in August 2024.

Exports from Mexico climbed to 8.7 million barrels in August from 7.2 million barrels in July, while Venezuela exported 1.5 million barrels in August, up from zero in July.

Venezuelan crude exports to the US were down from 3.8 million barrels in August 2024, while Mexican heavy crude exports were down from 9.3 million barrels in August 2024. Mexican crude production has fallen to 1.37 million b/d, although the government has unveiled plans to boost output to 1.8 million b/d.

Mexican and Venezuelan heavy barrels are exported to the US Gulf Coast, where refiners have invested in coking units to handle heavy grades.

The drop in waterborne heavy crude flows into the USGC could be partly due to refiners tweaking their operations to process more light crudes, which are relatively well supplied owing to the increase in US shale production.

EIA data shows the weighted average of crude processed at USGC refineries rising to 33.93 degrees API as of June 2025, compared to 32.5 degrees API in June 2020.