Canada’s Oil Patch Is Preparing For A Production Hike

At a time when U.S. shale, OPEC+, and dozens of oil producers have laid out blueprints to limit production in a bid to return the global oil industry to its former glory, Canada’s Oil Patch appears to be merely paying lip service to the notion of keeping production subdued.

Like everybody else, Canada’s oil and gas producers have been preaching capital discipline and assuring investors they have no intention of boosting spending, preferring to return capital to investors mainly in the form of dividends and buybacks.

But behind the scenes, Canada’s Oil Patch has been giving a nod and a wink to supply chain partners, telling oilfield services companies to get ready for prime-time action—and soon.

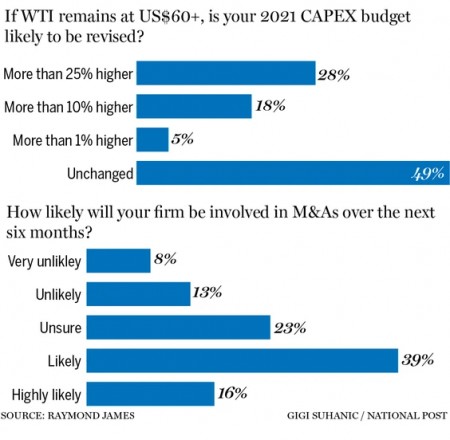

A survey by investment bank Raymond James has revealed that the majority of Canada’s mid-and small-cap oil and gas producers plan to increase their capital expenditure (Capex) this year by a significant margin.

More drilling

About 51% of oil and gas producers intend to ramp-up production over the coming months if oil prices remain above $60 per barrel with a good 28% of E&P companies saying they have increased their budgets by at least 25%.

So, where will this extra money be going?

More drilling, apparently.

In a separate survey, Raymond James says that a staggering 87% of oilfield services companies--comprising drilling, fracking, and construction companies--expect demand for their services to increase this year compared to a year ago.

Related:Can Big Oil Lure Investors Back?

But as Raymond James notes, production ramps by smaller Canadian players are unlikely to upset the delicate balance in the global oil markets.

A couple of days ago, OPEC said it expects global oil demand to bounce back to the tune of 6 million barrels per day in the current year, thanks to economic recovery by key consumers such as the United States, China, and the UK.

Canada’s smaller oil and gas companies will also be hunting for M&A deals.

A good 55% of respondents said they are either ‘likely’ or ‘highly likely’ to engage in M&A activity over the next six months.

That’s hardly surprising given how Canada’s oil patch has been turning to mergers as conditions there get increasingly dire.

Wave of Consolidations

A vicious one-two-three punch that started with a gloomy long-term future outlook due to rampant fossil fuel divestments, climate change policies, and decarbonization as well as shorter-term, but severe shocks from the COVID-19 crisis, has thrown Canada’s most important exports industry into an existential crisis.

Meanwhile, the drumbeat of exits by foreign oil firms bailing on the unprofitable tar sands has added an extra layer of gloom for an industry that’s responsible for a fifth of Canada’s exports.

It, therefore, comes as little surprise that Canada’s oil and gas producers are scrambling to merge as they hope to survive to see another oil boom.

A wave of consolidation has hit Canada’s Montney oil gas region as smaller companies sell their assets to other firms. Straddling northeast British Columbia and northwest Alberta, the Montney is one of Canada’s leading shale oil epicenters, producing 1.5 million barrels of oil equivalent per day, including 45% of Western Canada’s gas supply.

Faced with a six-year oil downturn, many smaller, debt-ridden oil and gas producers have been giving up the wait for a rebound and resorting to mergers in a bid to survive.

They have little recourse: Just like their shale counterparts further south, Canada’s oil industry has seen once-prolific credit lines dry up as the value of their reserves rapidly dwindle during the prolonged crisis. Eighteen Canadian companies tracked by Wood Mackenzie saw the amount of their reserve-based loans shrivel by some C$1.8 billion, or 22% in 2020.

Consequently, the Montney region recorded at least nine significant deals worth some C$2.3 billion ($1.75 billion) last year.

Two of the largest deals were the acquisition of acreage by U.S. major ConocoPhillips (NYSE:COP) from Kelt Exploration (TSE:KEL) for $325 million, as well as Canadian Natural Resources Limited’s (NYSE:CNQ) purchase of Painted Pony Energy in a $461 million deal. It’s worth noting that CNQ assumed Painted Pony’s total debt of approximately $350 million upon the purchase.

Companies operating in Canada’s natural gas sector have not been faring much better amidst the historic price crash. One of the Montney’s earliest gas drillers, Advantage Oil and Gas (TSE:AAV), sold a stake in its Glacier gas plant in July for C$100 million ($75.7M) in a bid to raise cash for operations but says it remains open to a complete merger.

Private equity bargain hunting

Dozens of companies in the Canadian Oil Patch, such as Bow Energy Ltd. (CVE:ONG) and Cequence Energy Ltd (TSX:CQE) filed for bankruptcy protection or opted to restructure. Others like Obsidian Energy Ltd. (OTCMKTS: OBELF), however, are going off the beaten path--by putting themselves up for purchase by private equity (PE) firms.

PE firms like Waterous Energy Fund have turned into trophy hunters, buying up distressed assets at dirt-cheap valuations. A good case in point is last year’s purchase of Pengrouth Energy Corp.for $740-million by Waterous’ subsidiary Cona Resources, representing less than a fifth of its more than $4B valuation at the time of the deal.

Massive discounts have pretty much become par for the course in Canada’s M&A space: A total of 23 such deals have been consummated in the year-to-date for an underwhelming total of $1.65 billion compared to $15.47 billion deal value from 42 M&A deals completed during last year’s corresponding period.

Waterous is a master of the game, having amalgamated six small producers from different deals into a giant it has dubbed Strathcona Resources Ltd., easily one of North America’s largest private-equity owned drillers with a daily production clip exceeding 60,000 barrels.

According to Waterous CEO Adam Waterous, there has never been a greater need for consolidation in Canada’s energy sector, noting that small oil and gas companies have been locked out of debt and equity markets, effectively leaving them orphaned. Waterous says these orphaned businesses need to come together if they are to survive the onslaught, which he does not see ending any time soon.

That said, it is worth noting that Canada’s bigger oil companies have been holding up pretty well, with the likes of Suncor Energy Inc. (NYSE:SU), Cenovus Energy Inc. (NYSE:CVE), Canadian Natural Resources Ltd. (NYSE:CNQ), and Husky Energy Inc. (TSE:HSE) having little trouble tapping debt markets.