US tight oil operators have for several months been depleting their inventory of drilled but uncompleted wells (DUCs) and, amid a slower drilling response, the number of ‘live’ DUCs in the country’s major oil regions slumped to 2,381 wells in June 2021, the lowest level since 2013, a Rystad Energy analysis reveals.

2021/08/04 11:25

Much was made about the impact of Biden's infrastructure bill on the U.S. oil and gas industry, but details suggest there is nothing to worry about.

2021/08/04 11:22

Nigeria’s oil industry has been confronted with a plethora of challenges – endless litigation, social unrest, majors regularly mulling a country exit, and all this against the background of a genuine societal demand to make oil revenues more equitable, more accessible and transparent.

2021/08/04 11:19

Mergers and acquisitions are how an industry normally handles tough times. Asset prices drop, some companies can no longer survive on their own and become targets for those with the means to grow through takeovers.

2021/08/04 11:16

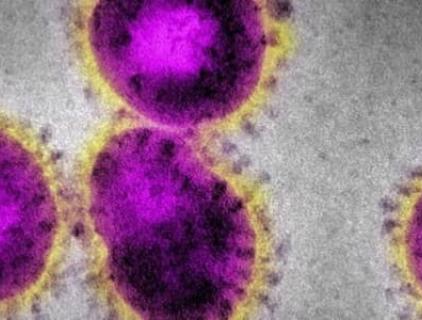

WTI Falls Below $70 On Global Rise In COVID Cases

2021/08/04 11:11

Crude oil markets have been jittery lately as additional OPEC+ output counters expectations of continued strong demand and coincides with concerns about the resurgence of Covid-19 in key markets. Yet some believe oil could still hit $80 a barrel.

2021/08/04 09:24

Oil prices fell early on Monday to start August with losses after posting a fourth consecutive month of gains in July. (2021)

2021/08/03 15:02

Oil prices started August in the red, and kept falling into the afternoon, with both benchmarks trading down more than 3% near Monday’s close.

2021/08/03 14:57

The U.S. Retains Its Crown As World’s Top Oil Producer,and the United States remains the world’s top oil consumer, averaging 17.2 million BPD in 2020. China was second at 14.2 million BPD, and was the only country in the Top 10 to report an increase in oil consumption in 2020.

2021/08/03 14:52

New Mexico broke an oil production record in May, pumping an average 1.22 million barrels daily as the Permian Basin returned to output growth again.

2021/08/03 14:49

Oil prices were trading slightly down early on Monday after having fallen 1 percent in Asia trade, as the bullish factor of tight market countered the bearish factor of the Delta variant spreading in many countries.

2021/08/02 18:53

Oil Market Still Far From Being Back To ‘Normal’.

Worry about oil demand sparked by the resurgence of Covid-19 in some parts of the world and a fund selloff in oil futures has reversed the recent price rally. OPEC+ reaching a deal about future production lent an assist.

Worry about oil demand sparked by the resurgence of Covid-19 in some parts of the world and a fund selloff in oil futures has reversed the recent price rally. OPEC+ reaching a deal about future production lent an assist.

2021/07/30 10:08

US tight oil operators have for several months been depleting their inventory of drilled but uncompleted wells (DUCs) and, amid a slower drilling response, the number of ‘live’ DUCs in the country’s major oil regions slumped to 2,381 wells in June 2021, the lowest level since 2013, a Rystad Energy analysis reveals.

Much was made about the impact of Biden's infrastructure bill on the U.S. oil and gas industry, but details suggest there is nothing to worry about.

Nigeria’s oil industry has been confronted with a plethora of challenges – endless litigation, social unrest, majors regularly mulling a country exit, and all this against the background of a genuine societal demand to make oil revenues more equitable, more accessible and transparent.

Mergers and acquisitions are how an industry normally handles tough times. Asset prices drop, some companies can no longer survive on their own and become targets for those with the means to grow through takeovers.

Crude oil markets have been jittery lately as additional OPEC+ output counters expectations of continued strong demand and coincides with concerns about the resurgence of Covid-19 in key markets. Yet some believe oil could still hit $80 a barrel.

Oil prices fell early on Monday to start August with losses after posting a fourth consecutive month of gains in July. (2021)

Oil prices started August in the red, and kept falling into the afternoon, with both benchmarks trading down more than 3% near Monday’s close.

The U.S. Retains Its Crown As World’s Top Oil Producer,and the United States remains the world’s top oil consumer, averaging 17.2 million BPD in 2020. China was second at 14.2 million BPD, and was the only country in the Top 10 to report an increase in oil consumption in 2020.

New Mexico broke an oil production record in May, pumping an average 1.22 million barrels daily as the Permian Basin returned to output growth again.

Oil prices were trading slightly down early on Monday after having fallen 1 percent in Asia trade, as the bullish factor of tight market countered the bearish factor of the Delta variant spreading in many countries.

Oil Market Still Far From Being Back To ‘Normal’.

Worry about oil demand sparked by the resurgence of Covid-19 in some parts of the world and a fund selloff in oil futures has reversed the recent price rally. OPEC+ reaching a deal about future production lent an assist.

Worry about oil demand sparked by the resurgence of Covid-19 in some parts of the world and a fund selloff in oil futures has reversed the recent price rally. OPEC+ reaching a deal about future production lent an assist.