Venezuela is ignoring U.S. sanctions with its plan to boost production to 1.5 million bpd by the end of the year, around three times the current output.

2021/07/28 17:58

The world’s third-largest crude oil importer, India, could join China in tapping into its strategic petroleum reserve in a bid to sell lower-priced crude to its refiners amid rallying international oil prices.

2021/07/28 17:51

Libya could boost its oil production to 1.6 million barrels per day (bpd) by the middle of 2022 if the industry has the necessary funding, Libya’s Oil Minister Mohamed Oun told Italian news agency Agenzia Nova in an interview published this week.

2021/07/28 17:39

Iraq wants another U.S. company to replace Exxon as a shareholder in the West Qurna 1 field, one of the country's largest after the supermajor leaves the country.

2021/07/28 17:27

It is not in Iraq's best interest to adopt renewable energy at the expense of fossil fuels, energy and oil expert Hamza al-Jawaheri told local Shafaq News Agency in an interviewon Monday.

2021/07/28 14:34

Argentina’s Oil Industry Is Finally Bouncing Back

2021/07/27 19:22

High oil prices and China’s crackdown on the use of oil import quotas could result in the lowest crude oil import growth at the world’s top oil importer since 2001, analysts tell Reuters.

2021/07/26 17:09

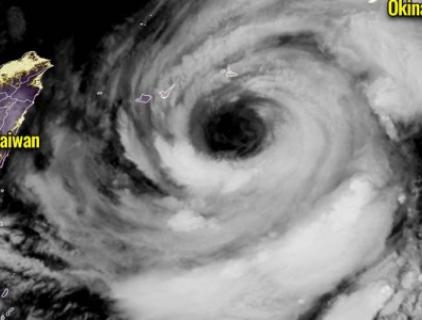

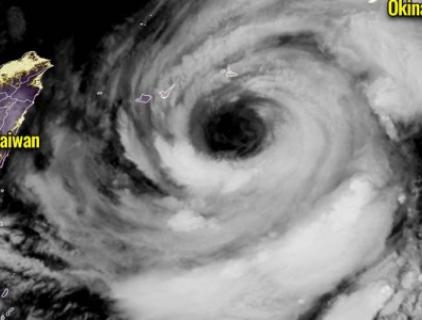

The In-fa typhoon, which caused devastating flooding in parts of China this week—claiming at least 33 lives—is expected to make landfall this weekend in a key area hosting some of the largest Chinese refineries and oil storage tanks.

2021/07/26 17:03

As the global oil and gas markets are recovering from the steep sell-off last Monday, threats in the market are not just linked to demand-supply concerns. Cybersecurity specialists reported this week that hackers managed to get access to a large amount of data from Saudi oil giant Aramco. The company has confirmed that around 1TB of (confidential) data was stolen from its servers. According to AP sources, the data has been put on offer on the darknet for a price of $50 million.

2021/07/26 16:45

Crude oil prices briefly dipped after the Energy Information Administration reported a crude oil inventory build of 2.1 million barrels for the week to July 16.

2021/07/22 14:27

After a period of relative stability in the oil market where U.S. crude benchmark WTI was trading above $70 a barrel for more than a month, traders are now bracing for a wild ride for the rest of the summer.

2021/07/22 14:21

America Looks For A Balance Between Oil Needs And Climate Reality

2021/07/22 14:19

Venezuela is ignoring U.S. sanctions with its plan to boost production to 1.5 million bpd by the end of the year, around three times the current output.

The world’s third-largest crude oil importer, India, could join China in tapping into its strategic petroleum reserve in a bid to sell lower-priced crude to its refiners amid rallying international oil prices.

Libya could boost its oil production to 1.6 million barrels per day (bpd) by the middle of 2022 if the industry has the necessary funding, Libya’s Oil Minister Mohamed Oun told Italian news agency Agenzia Nova in an interview published this week.

Iraq wants another U.S. company to replace Exxon as a shareholder in the West Qurna 1 field, one of the country's largest after the supermajor leaves the country.

It is not in Iraq's best interest to adopt renewable energy at the expense of fossil fuels, energy and oil expert Hamza al-Jawaheri told local Shafaq News Agency in an interviewon Monday.

High oil prices and China’s crackdown on the use of oil import quotas could result in the lowest crude oil import growth at the world’s top oil importer since 2001, analysts tell Reuters.

The In-fa typhoon, which caused devastating flooding in parts of China this week—claiming at least 33 lives—is expected to make landfall this weekend in a key area hosting some of the largest Chinese refineries and oil storage tanks.

As the global oil and gas markets are recovering from the steep sell-off last Monday, threats in the market are not just linked to demand-supply concerns. Cybersecurity specialists reported this week that hackers managed to get access to a large amount of data from Saudi oil giant Aramco. The company has confirmed that around 1TB of (confidential) data was stolen from its servers. According to AP sources, the data has been put on offer on the darknet for a price of $50 million.

Crude oil prices briefly dipped after the Energy Information Administration reported a crude oil inventory build of 2.1 million barrels for the week to July 16.

After a period of relative stability in the oil market where U.S. crude benchmark WTI was trading above $70 a barrel for more than a month, traders are now bracing for a wild ride for the rest of the summer.

America Looks For A Balance Between Oil Needs And Climate Reality