Solid oil demand is driving up the spot crude prices in every part of the world. This is a clear indication that the physical oil market is finally catching up with the recent rally in the paper market.

2021/06/24 10:30

Oil prices jumped further today after the Energy Information Administration reported a crude oil inventory draw of 7.6 million barrels for the week to June 18.

2021/06/24 10:21

“Canadian oil industry’s carbon emissions are among the world’s highest for every barrel of oil it pumps,” Reuters reported this week. A typical barrel of oil derived from the thick crude bitumen that naturally occurs in the Albertan oil sands (an energy-intensive process) emits three to five times more greenhouse gas emissions than the global average.

2021/06/24 10:08

Crude oil prices clambered upward on Monday afternoon as the market feared that Iran nuclear talks may be stalled after hardliner Ebrahim Raisi won the Iranian presidential election.

2021/06/23 14:20

Gulf oil producers are finding it difficult to diversify their economies away from their biggest export revenue contributor, and it may take them at least a decade to make any progress on this. This is what Moody’s forecast in a recent report, as quoted by Reuters, noting that this reliance on oil revenues would be the “key credit constraint” for the six members of the Gulf Cooperation Council: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

2021/06/23 14:10

For decades, the true numbers relating to Saudi Arabia’s level of crude oil reserves and production have been a subject of much debate and confusion, not helped by the obfuscation from the Saudis over precisely what these numbers are. The reason for obfuscation is that Saudi Arabia’s only source of real power in the world begins and ends with its oil reserves and production, so the higher these numbers, the more the power, and the lower the number the less the power.

2021/06/23 12:01

China National Petroleum Corporation has made an oil and gas discovery with reserves estimated at 900 million tons, Chinese media reported.

The discovery was made after six years of exploration work in the Tarim Basin in the Xinjiang Uygur Autonomous Region, northwestern China. The geology of the formation is challenging, the report said, requiring ultra-deep drilling, at a record 8,470 meters.

The discovery was made after six years of exploration work in the Tarim Basin in the Xinjiang Uygur Autonomous Region, northwestern China. The geology of the formation is challenging, the report said, requiring ultra-deep drilling, at a record 8,470 meters.

2021/06/22 10:52

Oil jumped by the most in a month amid a weaker dollar and as key timespreads surged with expectations for further supply declines at the biggest storage hub in the U.S.

2021/06/22 10:11

Oil may surge to $100 a barrel next year as travel demand rebounds, Bank of America Corp. said, the strongest call yet among major forecasters for a return to triple digits.

2021/06/22 10:04

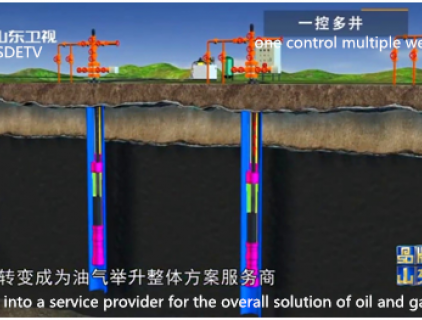

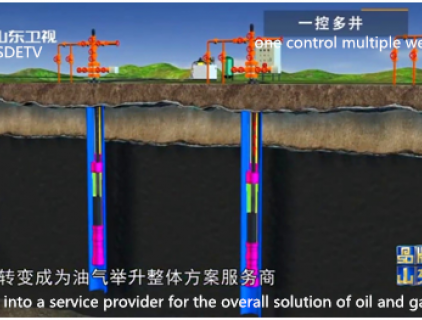

Recently, the Shandong Provincial Department of Industry and Information Technology recommended 9 outstanding companies to Shandong Satellite TV's《Brand Shandong》 column, and companies such as Yantai Jereh, Lanjian Intelligent, and Weima Co., Ltd. were selected.

2021/06/21 10:39

The reporter learned from the Tarim Oilfield Branch of China National Petroleum Corporation on the 20th: The Tarim Oilfield has drilled 56 100-ton wells in the Fuman Oilfield, and found out the geological laws of the oil and gas reservoirs in the Fuman region, and found a 1 billion tons. This is the largest oil exploration discovery in the Tarim Oilfield Basin in the past 10 years.

2021/06/21 09:40

Oil prices sank on Thursday as the Fed’s hawkish comments sent the dollar higher.

Crude oil is down more than 1% on Thursday afternoon, with WTI falling 1.32% at $71.20 per barrel, and Brent down 1.57% to $73.22. Both prices are still up on the week, but down nearly $2 from Wednesday highs.

Crude oil is down more than 1% on Thursday afternoon, with WTI falling 1.32% at $71.20 per barrel, and Brent down 1.57% to $73.22. Both prices are still up on the week, but down nearly $2 from Wednesday highs.

2021/06/18 17:40

Solid oil demand is driving up the spot crude prices in every part of the world. This is a clear indication that the physical oil market is finally catching up with the recent rally in the paper market.

Oil prices jumped further today after the Energy Information Administration reported a crude oil inventory draw of 7.6 million barrels for the week to June 18.

“Canadian oil industry’s carbon emissions are among the world’s highest for every barrel of oil it pumps,” Reuters reported this week. A typical barrel of oil derived from the thick crude bitumen that naturally occurs in the Albertan oil sands (an energy-intensive process) emits three to five times more greenhouse gas emissions than the global average.

Crude oil prices clambered upward on Monday afternoon as the market feared that Iran nuclear talks may be stalled after hardliner Ebrahim Raisi won the Iranian presidential election.

Gulf oil producers are finding it difficult to diversify their economies away from their biggest export revenue contributor, and it may take them at least a decade to make any progress on this. This is what Moody’s forecast in a recent report, as quoted by Reuters, noting that this reliance on oil revenues would be the “key credit constraint” for the six members of the Gulf Cooperation Council: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

For decades, the true numbers relating to Saudi Arabia’s level of crude oil reserves and production have been a subject of much debate and confusion, not helped by the obfuscation from the Saudis over precisely what these numbers are. The reason for obfuscation is that Saudi Arabia’s only source of real power in the world begins and ends with its oil reserves and production, so the higher these numbers, the more the power, and the lower the number the less the power.

China National Petroleum Corporation has made an oil and gas discovery with reserves estimated at 900 million tons, Chinese media reported.

The discovery was made after six years of exploration work in the Tarim Basin in the Xinjiang Uygur Autonomous Region, northwestern China. The geology of the formation is challenging, the report said, requiring ultra-deep drilling, at a record 8,470 meters.

The discovery was made after six years of exploration work in the Tarim Basin in the Xinjiang Uygur Autonomous Region, northwestern China. The geology of the formation is challenging, the report said, requiring ultra-deep drilling, at a record 8,470 meters.

Oil jumped by the most in a month amid a weaker dollar and as key timespreads surged with expectations for further supply declines at the biggest storage hub in the U.S.

Oil may surge to $100 a barrel next year as travel demand rebounds, Bank of America Corp. said, the strongest call yet among major forecasters for a return to triple digits.

Recently, the Shandong Provincial Department of Industry and Information Technology recommended 9 outstanding companies to Shandong Satellite TV's《Brand Shandong》 column, and companies such as Yantai Jereh, Lanjian Intelligent, and Weima Co., Ltd. were selected.

The reporter learned from the Tarim Oilfield Branch of China National Petroleum Corporation on the 20th: The Tarim Oilfield has drilled 56 100-ton wells in the Fuman Oilfield, and found out the geological laws of the oil and gas reservoirs in the Fuman region, and found a 1 billion tons. This is the largest oil exploration discovery in the Tarim Oilfield Basin in the past 10 years.

Oil prices sank on Thursday as the Fed’s hawkish comments sent the dollar higher.

Crude oil is down more than 1% on Thursday afternoon, with WTI falling 1.32% at $71.20 per barrel, and Brent down 1.57% to $73.22. Both prices are still up on the week, but down nearly $2 from Wednesday highs.

Crude oil is down more than 1% on Thursday afternoon, with WTI falling 1.32% at $71.20 per barrel, and Brent down 1.57% to $73.22. Both prices are still up on the week, but down nearly $2 from Wednesday highs.